Compounders had to fasten their seat belts to make it through 2022 — and they might need to do so in 2023 as well.

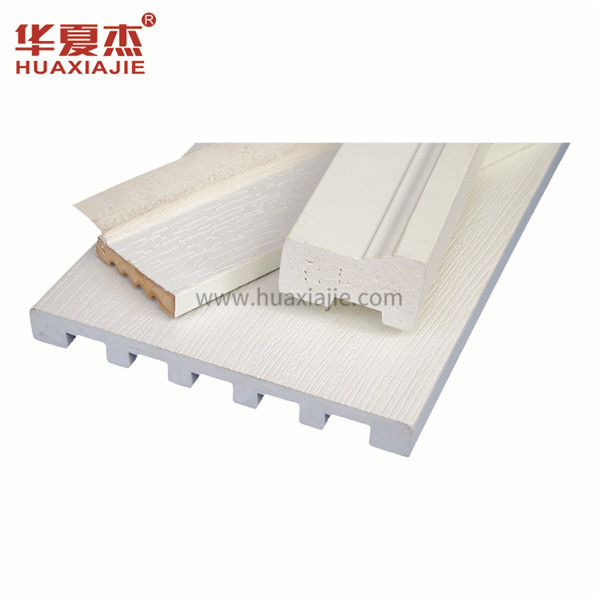

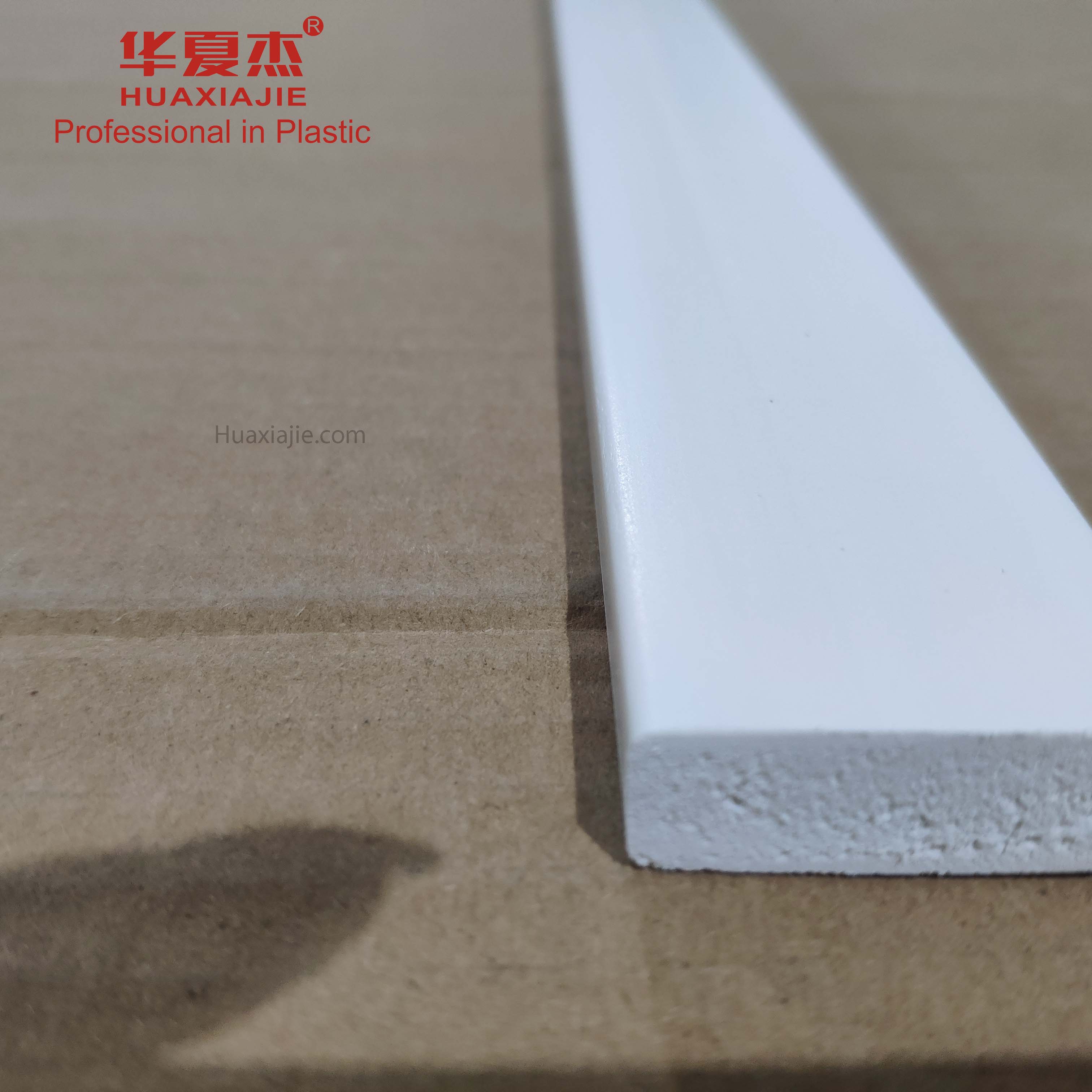

First-half demand growth was fairly strong, but inventories began to grow from COVID-shocked purchases just as a slowing global economy caused demand to slow down. Plafond Pvc Ceiling Panel

"It was really a tale of two halves," said Scott Anderson, president and chief operating officer at Polymer Resources Ltd. in Farmington, Conn. "It came out of the gates really hot in electrical/electronic, medical and consumer goods. We had record month after record month; it was kind of a continuation of 2021.

"Orders were strong until August, then they fell off a cliff," he added. "It was across all industries because of so much inventory in the supply chain and people starting to feel the effects of inflation. They didn't cancel orders, per se, but demand was slowing."

John Manuck, executive chairman of Techmer PM in Clinton, Tenn., said the fourth quarter of 2022 "probably isn't going to be good for anyone." The U.S. economy "is basically strong, but it can't last forever," added Bill Ridenour, owner of consulting firm Polymer Transaction Advisors in Foxfire, N.C.

At Aurora Plastics in Streetsboro, Ohio, CEO Darrell Hughes agreed with the "two halves" comparison. "At first, it was a continuation of the post-COVID boom, but then in the second half it slowed considerably," he said.

"Our business is still relatively strong, but because of inventory destocking in the value chain, we're trying to prepare for the unknown, whether it's inflation or higher interest rates," he said.

"I'd say that 2021 was an excellent year and 2022 was a good year," said Jean Sirois, managing director at RTP Co. in Winona, Minn. Phil Karig, principal of Mathelin Bay Associates consulting firm in St. Louis, added: "Generally, everybody is looking at the current situation and seeing less inquiries for new business."

In the first half, customers of Westlake, Ohio-based Geon Performance Solutions "were still taking advantage of demand from their markets or working off the backlog," Senior Vice President and Chief Commercial Officer Larry Shaw said.

"We started to see signs of slowing in some segments in June, but our backlog kept pressure on our order book," he added. "In the fourth quarter, we're seeing significant slowing and many customers are working to reduce their inventory."

Sales at OptiColor Inc. in Huntington Beach, Calif., are up 20 percent thanks to specialty markets that support military demand worldwide and plastic sheet applications, according to President and CEO Jennifer Bryan.

LyondellBasell Industries of Houston has completed the integration of A. Schulman Inc. into its Advanced Polymer Solutions unit. That 2019 transaction created North America's largest compounder.

"With the integration now complete, I look forward to increasing our agility, speed and customer focus to maximize the value of this business," Executive Vice President Torkel Rhenman said.

He added that in the third quarter, the unit's margins were pressured by higher feedstock and energy costs.

"We expect similar results from this segment during the fourth quarter, with a small volume improvement from increased automotive production," he added.

At Avient Corp. — a leading compounder and concentrates maker based in Avon Lake, Ohio — demand was strong in the first half, and as the firm progressed into the second half, customers "rightsized their inventory levels based on the actual supply chain realities of high inventory and lower consumer demand," Woon-Keat Moh said. He serves as president of the Americas and Asia for the firm's color, additives and inks unit.

The supply chain issues that had plagued compounders since early 2020 had lessened by 2022. Supply chain snarls first were caused by the uncertainty of the COVID-19 pandemic and then were made worse by the ice storm that hit Texas in early 2021. That unexpected event knocked out production capacity for many raw materials used to make compounds and concentrates.

"The situation has improved, especially on resins," Avient's Moh said. "However, we still have challenges on certain grades of pigments and additives. These remain short, especially with European-based manufacturers.

"We have close relationships with our partners, and our size does benefit our customers in these situations," he added. "We continue to monitor the situation and work closely with our partners."

High inventories also are keeping resin prices down, according to Ridenour of Polymer Transaction Advisors.

"For the most part, supply chain problems have been worked out," said Andy Ubhi, CEO at Peacock Colors in Addison, Ill. "We still have some issues getting some types of polyethylene [resin], but our lead times are good and we can get our customers what they want."

At Ampacet Corp. in Tarrytown, N.Y., some supply chain issues from 2021 carried over to the first half of 2022, according to Mike Gaudio, global business and marketing vice president. But the firm started to see improvement by summer, and then slower second-half demand "gave suppliers a chance to catch up."

Download and read this week's issue here..

"Like with COVID itself, there was a lot of uncertainty, and that fear factor led to a general hoarding mentality," said Suresh Swaminathan, president of Teknor Apex Co. in Pawtucket, R.I. "People weren't sure what tomorrow would be like, so they built more inventory than was needed.

"Then when demand eased up, they had an inventory glut. It should work out in the first quarter [of 2023] and we'll come to new normal," Swaminathan added.

Star Plastics of Ravenswood, W.Va., had supply problems through June, according to CEO Donald Wiseman, but now "more than enough materials are available."

Like many compounders, Star is looking to diversify its supplier base and have alternate suppliers in place. "There were supply issues these last two years, and no one wants to get stuck like that again," Wiseman said.

Sirois said RTP is like many other compounders in "trying to wind down inventory for the end of the year and seeking alternatives in our supply chain."

Keith Rodden, owner of the Compound Solutions LLC consulting firm in Gallatin, Tenn., said the average injection molding compound customer is "trying to work down inventory with prices falling."

"They can wait until the last minute so as not to get stuck with high prices," Rodden added.

A wide variety of end markets have provided compounders with growth in 2022. At Plastics Group of America in Woonsocket, R.I., Executive Vice President Mike Rosenthal said the firm was selling glass-filled PP and similar compounds into "adult toys" such as jet skis and snowmobiles.

Indianapolis-based ATC Plastics LLC had seen demand growth in pipe, film and other construction markets. Teknor also had seen growth in building and construction, with sales into wire and cable growing "like gangbusters," according to Swaminathan.

Karig said filled PP compounds were selling well into a recovering automotive market. Americhem Inc. in Cuyahoga Falls, Ohio, saw strength in health care, where CEO John Richard said the firm's value proposition "resonates with customers."

Packaging, which accounts for around 75 percent of Ampacet's sales, continued to do well in the Americas, Gaudio said. Shruti Singhal, CEO of Chroma Color Corp. in McHenry, Ill., is still seeing growth in health care. "We're not just on the bandwagon," he added. "We've been in health care for a while."

The electrical/electronic market grew for Star. Ubhi said Peacock has seen strong business in housewares, outdoor furniture products, and food and beverage applications such as bottles, caps and closures.

Moh also identified health care as a growing end market for Avient. "It's a key focus area where we have a strong value proposition and brand," he said.

LyondellBasell's APS unit has seen mixed financial results in 2022. The unit's third-quarter sales were flat at $1.3 billion, but operating profit was down almost 60 percent to $38 million. In the first nine months of 2022, the unit's sales were up 6 percent to $4.13 billion, but operating profit slipped 24 percent to $226 million.

At Avient, the firm's color, additives and inks unit saw third-quarter sales drop almost 4 percent to $565 million, even as operating profit ticked up almost 3 percent to around $69 million. For nine months, sales were flat at just under $1.9 billion, with operating profit up 6 percent to almost $257 million.

For Avient's specialty engineered materials unit, third-quarter sales were up almost 12 percent to $258 million, with operating profit up almost 5 percent to more than $31 million. For nine months, sales were up almost 9 percent to $743 million, with operating profit up 6 percent to $104 million.

Compounders and concentrate makers also have been active in mergers and acquisitions in the last 12 months. Geon made two first-half deals, starting by acquiring PVC compounder Roscom Inc. That firm makes flexible and rigid PVC compounds for indoor and outdoor applications at a site in Croydon, Pa.

Geon then acquired PVC compounder Cary Compounds LLC of Manalapan, N.J. Cary makes flexible and semi-rigid PVC compounds for wire and cable, profile extrusion, injection molding and other applications.

Peacock's Ubhi acquired a majority stake in Poly Compounding LLC, a toll compounder in Elgin, Ill. Poly Compounding specializes in highly engineered compounds and processes, especially for heat- and shear-sensitive applications. Poly Compounding is located about 30 miles from Peacock. In addition to Peacock, Ubhi also owns Vortex Liquid Color Inc. of Sheboygan, Wis.

Star found a new owner in the second half of the year, when it was acquired by Akoya Capital Partners. Doug Ritchie founded Star in 1988. Akoya is a Chicago-based private equity firm. Its current portfolio includes nine manufacturing and service companies.

Chroma and Teknor Apex each made multiple first-half deals. Chroma bought dyemaker Adam, Gates & Co. LLC of Hillsborough, N.J. Chroma also snagged J. Meyer & Sons Inc., a West Point, Pa.-based maker of color concentrates for medical and pharmaceutical markets. Chroma, owned by New York investment firm Arsenal Capital Partners, has made nine deals in less than four years.

Teknor Apex acquired the dry color business of Dorum Color Co. of Akron, Ohio, and then added Lanier Color Co. of Gainesville, Ga. The Dorum deal is an asset purchase, with Dorum customers now supplied from a Teknor Color plant in Henderson, Ky. Lanier makes color concentrates and specialty compounds, with a focus on the building and construction market.

In September, Techmer found a new majority owner for the second time in less than three years. Private equity firm Gryphon Investors of San Francisco bought a majority stake in the firm. Techmer management, including founder Manuck, and investment firm SK Capital retain minority stakes. Manuck, who began his plastics career in 1969 at a resin plant operated by Monsanto Inc. in Massachusetts, said he will continue to have a "more strategic role" with Techmer.

Aurora in October merged with Enviroplas Inc. of Evansville, Ind., to create a larger company with a broader product offering. Enviroplas operates out of two sites in Evansville. The combined firm offers a broad range of custom compounding capabilities and technologies, including engineered polymers, PVC compounds and thermoplastic elastomers. Aurora has been majority owned since 2021 by investment firm Nautic Partners of Providence, R.I.

Compounders grew in 2022 by adding equipment, hiring more employees or in other ways.

Americhem in April completed an expansion of its compounding plant in Morrisville, Pa. The 60,000-square-foot expansion includes a 20,000-square-foot clean compounding room for medical materials. A new design center at the site includes pilot-scale production to assist customers with new product design and small lot qualification.

In August, Aurora broke ground on a 20,000-square-foot expansion in Streetsboro. The expansion will allow the firm to install a new blending line that will increase the site's annual production capacity by 100 million pounds. It's set to be completed by the end of 2023 and will create 30 new jobs.

Ampacet in September opened a new production plant in Brembate, Italy. The new site doubles the firm's additive capacity. Polymer Resources has added another 60,000 square feet of operating space in Rochester, N.Y.

Avient recently expanded its plant in Norwalk, Ohio, to make Capture-brand oxygen barrier solutions. OptiColor added a second location in Huntington Beach, Calif., with Bryan saying the firm expects continued growth of 10-15 percent for the next few years.

Peacock purchased a 50,000-square-foot building in Elgin, Ill., near Poly Compounding. The firm plans to install three extrusion lines there.

Star added an extrusion line in October and plans to add two more next year. The firm also plans to open a sales office in Mexico, Wiseman said, because of an increase in work reshoring to North America.

Geon added more than 150 million pounds of capacity since early 2021 through expansions and acquisitions. ATC increased its capacity by 50 percent in April when it installed a new Farrel continuous mixer. Plastic Group also added an extrusion line and plans to hire six to eight more production workers, Rosenthal said.

Sustainability remains a major focus for compounders, with more customers seeking to reach targets requested by brand owners.

"There's been a steady push to the recycled side," said Tom Stevning, owner of ATC Plastics LLC. "It's here to stay. And customers are looking for different things for different applications."

At Polymer Resources, Anderson said customers are asking for more post-industrial feedstock. "We see the trend, but it's a challenge to get a consistent clean feedstock stream," he added.

"We're seeing lot more interest in recycling from brand owners," Techmer's Manuck said. "I think before, [interest] sometimes was for show, but now they take it very seriously."

"[Sustainability] is more important now than it was about two years ago," Rodden added. "For compounders, availability and use of recycled content is extremely important."

"We're trying to figure out how we fit in the sustainable value chain as a compounder," said Swaminathan at Teknor Apex. "Recycled content is one of the many things we can bring to the table."

The challenge for compounders and other processors, according to Karig, is that recycled materials or bioplastics can be more expensive than standard materials. There's also "a mismatch" between the amount of recycled material available not being as much as brand owners want to use in their products, he said.

"Sustainability has become a requirement," Americhem's Richard said. "We're a multi-industry provider, and what customers want in sustainability can be different based on markets and parts of the world.

"It's not one monolithic offering," he added. "We'll formulate solutions to increase the value of our products. Sustainability is great from a long-term standpoint because it creates opportunities for value creation and growth."

At RTP, Sirois said the industry needs more post-industrial and post-consumer material to meet environmental, social and governance goals.

Singhal at Chroma added that customers now "are more comfortable with recycled content, and consumers are starting to understand the value."

This year, Geon published its first ESG report that supports operational excellence, shaping thriving communities and collaborating across the value chain. Shaw said addressing the sustainability needs of customers is "an integral part of this plan."

Also this year, Geon launched a closed-loop recycled PVC product with a customer. The firm has been working with customers to design recycled products to meet high-end applications.

"[OptiColor] is working with the majority of sustainable materials as they are introduced to trial so that we can make educated recommendations to our clients," Bryan said.

Star, in January 2023, will launch a line of sustainable products to meet demand for recycled content.

Ubhi said liquid colors offered by Peacock "are the best way to do sustainable color, because they have a lower carbon footprint and don't use a carrier resin."

Moh said sustainable solutions "are the main driver of growth" for Avient. "We've developed solutions to address gaps in mechanical recycling and have launched over 20 solutions in this area."

Avient's sustainable solutions include recycle-friendly toners, coloration technology to manage undertones of post-consumer resin and Cesa A4R additives to address mechanical property deficiencies in recycled resin.

LyondellBasell's Rhenman said that in his initial meetings with customers, he saw "the considerable and growing demand for circular and low-carbon solutions."

"The APS business provides a natural extension of the value chain for LyondellBasell's sustainable solutions and our team is actively addressing these opportunities," he added.

Looking ahead to 2023, executives at many compounding and concentrates firms are optimistic, in spite of some uncertain economic indicators.

"Profitwise, we're still growing and taking market share," said Wiseman at Star. "There's some uncertainty about Europe, but in general things are looking good."

At OptiColor, Bryan said she expects prices will start to come down in 2023, with the supply chain continuing to improve. Bryan added that she believes single-use plastic suppliers "are in for a challenging future and that we are going to see many changes."

For Geon, Shaw said although many customers are predicting a slow first quarter and slightly better second quarter, many of them are well positioned for growth from the federal infrastructure bill. He added that upgrades in water infrastructure, the electrical grid and electrification will help growth in 2023 as well.

"More inventory is moving out," RTP's Sirois said. "Moving forward, we're optimistic about 2023."

At Ampacet, Gaudio said that even though market conditions may soften in 2023, "it won't be catastrophic, and if we do have a recession, it won't be a deep one."

ATC Plastics has averaged 22 percent growth for the last five years, but Stevning said business "could slow down a bit" in 2023.

"It won't go back to pandemic levels," he added. "We expect another good year."

"[2023] could be down some, but we're bullish on trends long term," Aurora's Hughes added. "Housing could be a drag, but we're seeing growth in other areas. I'm confident we'll gain share even with market challenges."

Even though 2023 might have some challenges, Americhem's Richard said that "there are opportunities for companies with clarity to see what the future may look like," he added. "We continue to pivot to higher growth and less cyclical markets."

"Everyone is going to see a correction in the fourth quarter, but you have to have some optimism," Techmer's Manuck said. "We'll have to wait and see how January looks."

At Polymer Resources, Anderson said the market should work through the supply situation by the middle of the year. But economic headwinds could make it a challenge to match the growth of the previous three years. "We'll just have to work harder," he said.

Do you have an opinion about this story? Do you have some thoughts you'd like to share with our readers? Plastics News would love to hear from you. Email your letter to Editor at [email protected]

Please enter a valid email address.

Please enter your email address.

Please select at least one newsletter to subscribe.

Staying current is easy with Plastics News delivered straight to your inbox, free of charge.

Plastics News covers the business of the global plastics industry. We report news, gather data and deliver timely information that provides our readers with a competitive advantage.

Decorative PVC Mouldings 1155 Gratiot Avenue Detroit MI 48207-2997